Insights from the March 2025 Canada Compensation Planning Survey

The March 2025 Mercer QuickPulse® Canada Compensation Planning Survey, which gathered responses from 404 employers, reveals key trends in annual compensation planning, promotions, off-cycle adjustments, approaches to pay transparency, and the impact of remote work on compensation strategies.

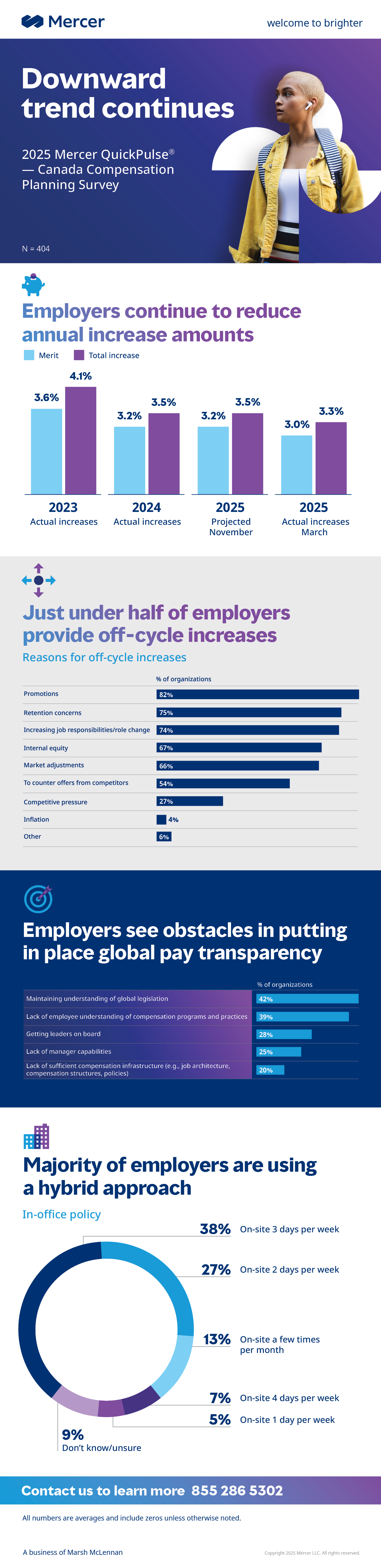

Actual merit and total increases

A significant 92% of employers in Canada either have implemented or plan to implement increases in merit or annual pay in 2025. Among these, 47% report that their budget allocated for these increases is comparable to that of 2024, while 37% indicate that they reduced their budget size. The survey shows that the actual mean merit increase, including zero increases, is 3.0%, while the total increase averages 3.3%.

However, certain sectors delivered lower or higher increases in merit and total increase budgets compared to the national results. The non–financial services sector reported a mean actual merit increase of just 2.7%, but had a total increase budget above the national average at 3.4%. Total increases include merit, but also promotional increases, off-cycle increases, across-the-board adjustments and cost-of-living increases. Falling below the national average is the high-tech sector, with an average merit increase of 2.8% and total increases of 3.2%. In contrast, mining & metals saw higher-than-average increases at 3.5% for merit and 3.6% for total increases.

Promotions and off-cycle increases

On average, employers expect to promote approximately 9.8% of their workforce in 2025. This is up from the 8.0% of expected promotions reported in the 2024 survey. The expected average increase in pay associated with a one-level promotion is 8.8%.

In terms of off-cycle pay increases, just under half of respondents reported that they have either provided or plan to provide such off-cycle adjustments in 2025. The primary reasons cited for these off-cycle increases include promotions, retention concerns, and changes in job responsibilities. Typically, these increases are funded through the employer’s budget at the business unit or departmental level.

Pay transparency initiatives

Given that 55% of respondents’ operate in countries in addition to Canada, the survey included questions regarding global pay transparency strategies. Only 18% of respondents confirmed that they have developed and implemented a global pay transparency strategy, while the remaining 82% reported that they are still in the process of developing or implementing such strategies. Notably, 23% of respondents indicated they do not plan to address pay transparency on a global scale in the coming year.

Two significant obstacles to implementing a global pay transparency strategy include maintaining an understanding of global legislation and addressing employees’ lack of understanding of compensation programs and practices.

Remote work and compensation

The survey also explored the impact of remote work on compensation strategies. Just under 70% of respondents reported that their employers have adopted a hybrid work model with local office focus and allowing flexibility between remote and office environments. Twenty-three percent of employers remain primarily office-based.

For those organizations permitting full-time remote work, 41% pay employees based on the market rate of the primary office location. Twenty-three percent of employers pay according to the market rate of the employee’s home location, while 10% utilize national rates for compensation.

Looking for more information?

If you are interested in further exploring topics such as pay transparency or the differences in increases between industries, you should participate in the next Mercer QuickPulse® survey. We’d love to help you analyze your current compensation strategy to identify areas for optimization. Give us a call at 855-286-5302 or email us at surveys@mercer.com.