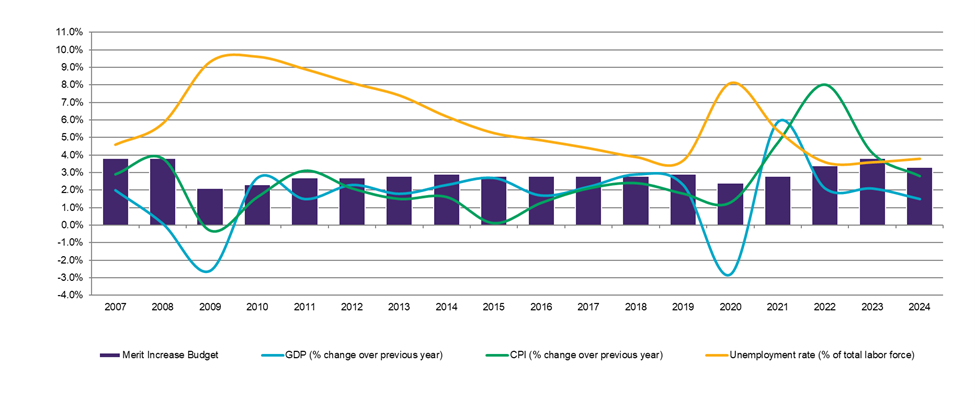

Toward the end of 2023 Mercer, along with other companies, released compensation planning reports with the final look at what employers were budgeting for annual increases, both merit and total rewards. Additionally, the report included planned structure adjustments and thoughts on various pay practices and payouts. But, come Q1 in 2024, what exactly happened? Did employers stick to their projections? How did Financial Services & Insurance payout relative to the overall market?

It’s time to find out.

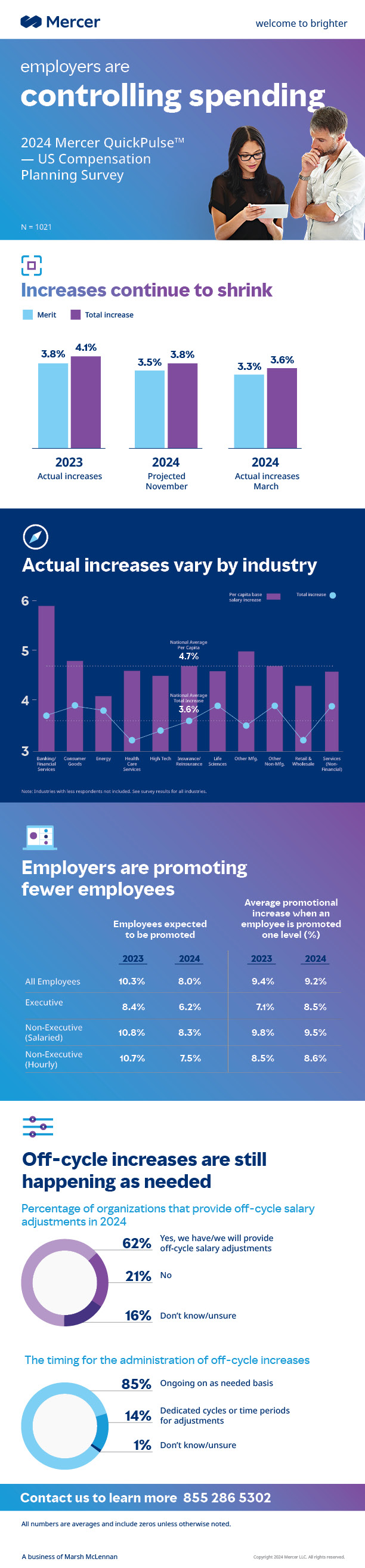

Actual increases lower than projected

In November 2023, the projected average merit increase budget for 2024 was projected to be 3.5% and the average total increase budget was projected to be 3.8%. Now, in March 2024, we see that the average merit increase that was delivered was 3.3%, with 3.6% total increases reported across the more than 1,000 participating organizations. While still higher than before the pandemic, and above inflation, increases are continuing to trend downward.

Several industries did provide average merit increases above 3.3%. Consumer Goods, along with Services (on-financial), Mining & Metals and Chemicals all gave average actual merit increases of 3.6%. Transportation Equipment provided the highest average increase – 3.9%.

A few, including Healthcare Services and Retail & Wholesale, were well below, only providing 2.9% average merit increase (including zeros). Note that a significant proportion of the workforce in both of those industries is paid on an hourly basis, for whom employers continue to struggle with hiring and retention.

Financial services and Insurance paid both merit and total increases in alignment with the national average except that Financial Services paid an average of 3.7%, slightly higher.

Fewer promotions

Compared to what they reported in 2023, employers have promoted or are planning to promote a smaller percentage of employees in 2024 — 8.0% on average of all employees (down from 9.3% projected in November). However, the base pay increase they plan for a one-level promotion is similar to last year. Therefore, the cost savings for many may come by being more selective and promoting fewer employees while advancing those key performers they want to develop and reward with a new opportunity.

On average, companies plan to spend or have spent 1.1% of their salary budget on promotions. Financial Services is higher, at 1.5%, while Insurance is spending less, at 0.8%.

Off-cycle increases

Off-cycle increases are still happening — 62% of respondents indicate they are giving off-cycle increases on an as-needed basis for a variety of reasons, including, but not limited to, promotions, retention concerns, equity increases, and market adjustments. This is 10% higher than the 52% reported in November. Also notable is the fact that the off-cycle increase spend is highest for the hourly population (1.0% on average as compared to 0.9% for nonexecutive salaried employees and 0.7% for executives).

Only 14% of employers have a dedicated time during the year for off-cycle increases and most commonly they are funded at the Business Unit/Department level through their business/departmental budgets.

Incentive awards

Short-term incentive payouts for 2023 performance were very similar to those from the prior year. Both years saw a very small percentage paying more than 150% of target and almost half paying from within 10% of target up to 150%.

Likewise, the long-term incentive plan payout versus target was similar this year to last.

Salary structures

Formal salary structures still reign as the dominant way of managing pay. Now that the dust has settled around working from home, returning to the office and hybrid work employers reported that only 27% of organizations that operate in multiple locations use a national approach to pay (vs. implementing geographic differentials). Typically, those that use geographic differentials have a national salary structure for all employees (78%), with geographic variations of the structure to account for locations with varying costs of labor.

The average salary structure adjustment for 2024 across different employee levels was 3%, excluding zeros. Both Financial Services and Insurance made smaller salary structure adjustments than the national average, reporting 2.9% and 2.7% respectively.

Future projections

Some companies are already asking about pay increase projections for 2025. However, knowing that the majority of companies don’t even start thinking about their annual increase planning until the fall, we will be getting a “first look” at budget projections for 2025 through our Compensation Planning Pulse Survey in late July, with another survey in mid to late October. Prior to that, we will be running another Mercer QuickPulse™ Survey that will collect information, and provide valuable insights, on a hot topic. Stay tuned!

Sign up here to be notified when the next survey opens.

We are using the Banking/Financial Services and Insurance/Reinsurance data cuts from the 2024 Mercer QuickPulse™ - US Compensation Planning Survey to represent what we call Financial Services and Insurances in the article.