It’s that time of year again! Comp planning season is upon us, and Mercer’s latest US Compensation Planning Survey gives us a first look at what merit and total increase budgets will be for 2025.

You may recall that what was actually delivered to employees, as reported in March 2024, continued the downward trend of initial projections in August being higher than the actual increases delivered during the annual increase process, typically during the following Q1. While we expect to see the same this year, only time will tell. The next version of the Mercer QuickPulse® Compensation Planning Survey, to be released in November, will give us a better view.

Although a wide range of topics are covered in the full survey, for now, let’s look at what more than 1,100 US corporations provided as their original budget projections as well as how they are handling promotions and pay transparency.

Base pay changes

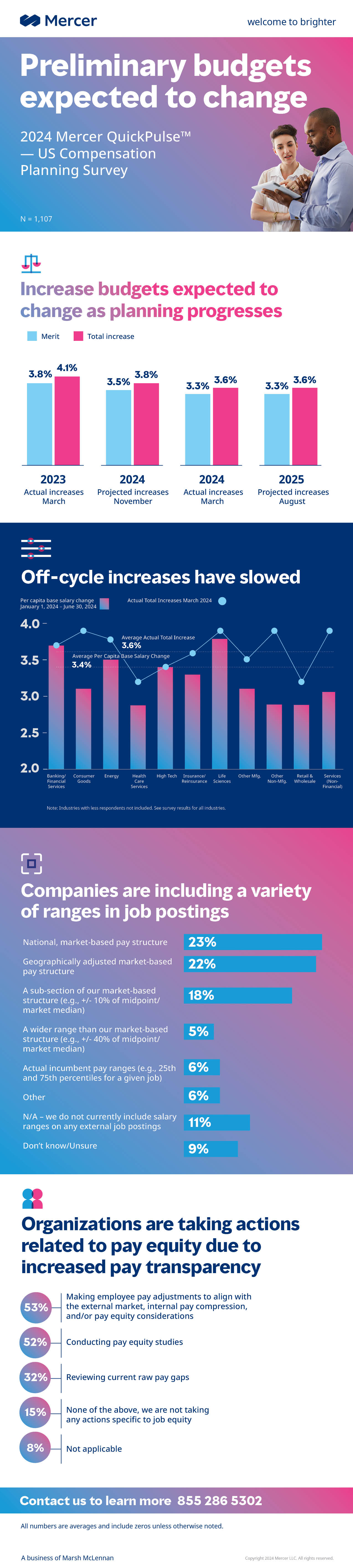

“Preliminary” is how 86% of respondents categorized the status of their 2025 salary increase budget. The preliminary status likely explains why their projected 2025 merit increase budget and total increase budget of 3.3% and 3.6%, respectively, are exactly what was reported as the actual increases delivered in March 2024. Come November 2024 and March 2025, we will see what is finally budgeted and then delivered. Mercer’s guess is that the downward trend will continue.

There are some differences between industries in merit budget forecasts. Industries that are higher than the average include High Tech and Life Science (both 3.5%). Health Care Services, Retail & Wholesale, and Consumer Goods are all predicting lower budgets, at 3.0%, 3.1%, and 3.2%, respectively.

The delivery of pay increases outside of the annual process seems to have stopped. In March 2024, the average total increase delivered was 3.6%. When we look at how much same incumbent pay has changed between January 1 and June 30, 2024, which would include that 3.6% increase, we see an average change of only 3.4%. Though the methodologies differ, employers are no longer providing market adjustments or other pay increases meant to retain employees at the rates they were in 2021 and 2022.

Additionally, companies are not seeing the need to differentiate budgets by leaders or business units. Most companies reported that all leaders or business units receive the same increase budget (i.e., a percentage based on their salary budget).

Promotions

Employers are planning to promote just under 10% of employees in 2025, which is up slightly from the 8% they predicted promoting in 2024. For companies that have a separate promotional budget, the average promotional increase budget for 2025 is 1.0%.

This time, Mercer asked about the frequency of promotions. Almost half of respondents said they don’t do promotions only at a focal point during the year but do them “as needed.” Only one in five respondents limit promotion cycles to once per year.

Interestingly, employers are increasing pay for lateral job changes often, assuming certain conditions are met.

Pay transparency and equity

It’s safe to say that organizations and employees have accepted pay transparency as the norm. While they are, of course, complying with laws, just under 30% are exploring sharing pay ranges beyond what’s required by law. Another 19% replied that they already share pay ranges both internally and externally in a standard way.

A few outstanding questions about pay transparency continue to be asked by employers, mostly due to the ambiguity of the laws.

The second question is, what salary range is included in the job posting?

Among the survey respondents, there is an even distribution, of around 20% each, for employers using the following as the ranges in their external job postings:

- National, market-based pay structure

- Geographically adjusted market-based pay structure

- A subsection of our market-based structure (e.g., +/- 10% of midpoint/market median)

Employers do recognize that pay transparency requirements will continue to expand not only nationally, but globally. Some of the most common actions they are taking to prepare are assessing the competitiveness of their pay levels and/or compensation structures, enhancing the job architecture for greater consistency and alignment with work being performed, and conducting pay equity studies.

Just what are employers doing to understand and address pay equity challenges now that pay transparency is making pay less of a ‟black box”? Annually, 38% conduct a comprehensive pay equity analysis and another 24% report doing so less frequently than annually.

Some of the key challenges organizations tackle with pay equity is how they plan to communicate the unexplained pay gaps and how they plan to address them. Within this group of employers, the majority responded that they are not disclosing anything externally. Internally, they train and rely on HRBPS and managers to communicate pay equity talking points to employees.

Stay tuned

How does all of this relate to what you’re doing in your organization? As for 2025 plans, don’t miss out on the next Mercer QuickPulse® Compensation Planning Survey, which opens on October 21. If you participate in the survey, you will be sent the result at no cost.

Have additional questions? Give us a call at 855-286-5302 or email surveys@mercer.com.