A detailed look at pay compression, and how it is related to pay transparency.

Pay transparency started as a common topic of conversation post-pandemic, during a different labour market. Since then, minimum wage has increased, overtime eligibility tests have changed, and the employee/employer leaning contract has turned around. Pay transparency is a real expectation among job seekers, particularly those who are newer to the workforce. While openness about pay may contribute to pay equity and beneficial discussions around merit and performance, it could reveal challenges with some aspects of a company’s pay management structure, such as pay compression. Let’s take a look at what pay compression means and how employers might address it in their workforce today.

What is pay compression?

Pay compression is when a company has little to no differences in pay between employees who have different levels of experience or skills. For example, it may occur when new employees are hired at higher salaries than existing employees who have been with the company for a longer period of time. Another instance of pay compression is when an individual contributor’s pay is approaching their manager’s pay level, which may sometimes be warranted due to the technical skills or experience of the individual contributor. Other reasons that pay compression can happen include changes in the job market, inflation, or the need to attract and retain new talent.

When pay compression occurs, the expected pay differences as a result of the organization’s identified compensation drivers (which often include experience and performance) do not follow. This could be attributed to a company’s recruitment and retention pressures.

Identifying pay compression and how it happens

Several different factors can result in pay compression. Increases to the minimum wage provinces and territories can create instances of pay compression within jobs. These changes in minimum pay compress existing pay differences between employees (mostly among those with lower-wage roles that are affected by the increased minimum wage).

Pay compression within a job can happen if hiring pressures, such as a real (or perceived) limited supply of candidates, might prompt an organization to bring in new hires at pay rates equal to or sometimes even higher than those of more experienced, high-performing employees.

Pay compression between jobs can happen if high pay rates for certain “hot jobs” cause unintentional pay compression between managers and their direct reports, between peer jobs within an organization, and/or between job levels within a progression (for example, Accountant I, II, and III).

Pay compression and compensation drivers

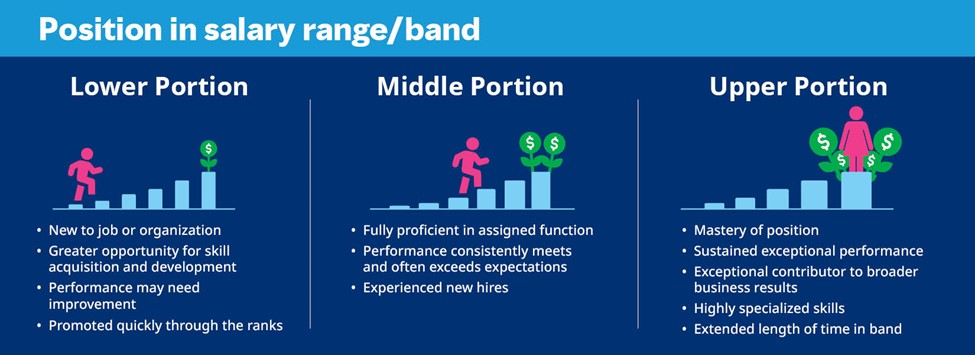

Identifying pay compression and mitigating its issues in an organization starts by ensuring that the organization’s leaders have a clear mutual understanding of the compensation drivers at play and how they should be influencing pay. These compensation drivers are the factors that influence where a job is positioned in a pay structure (that is, grade or range) or where an employee is positioned within a pay range.

Factors that influence where a job is positioned include:

- Grade: Pay grade is typically the most important factor in driving pay, especially in companies with a well-established grade/level structure.

- Job characteristics: Some organizations prioritize pay differences between job families, as the responsibilities, skill sets, and requirements (for example, education and certifications) may vary.

- Work location: Pay differentials by geography reflect differences in external labour market conditions (for example, labour costs and cost of living).

In contrast, factors that influence where an employee is positioned in a pay range are typically decided by:

- Experience: Many organizations reward general experience, but the extent to which firm-specific experience (tenure) is rewarded varies.

- Performance: Pay-for-performance companies tend to show stronger associations between performance ratings and pay. Performance ratings, more so than base salary, may drive differentiation of pay to provide short- and long-term incentives.

Impact of Pay Compression on Pay Transparency

So, what happens when compression exists and pay ranges are revealed to employees?

Pay compression can create a perception of unfairness among employees. When individuals with different levels of experience or skills are compensated similarly, it can be seen as undervaluing the contributions of more experienced or skilled employees.

There is usually not a single answer as to why an employee is positioned in a particular salary range, whether it's because of an overstated understanding of performance or a genuine correlation between experience and salary range penetration. Let's be real. In many cases, especially in organizations with pay compression, the employee is not in the appropriate position within the pay range.

Another issue arises when employees start discussing their pay with their co-workers. This initiates internal (and sometimes external) dialogue regarding who is a better performer or more experienced. When employees perceive that their skills and experience are not being adequately recognized or rewarded, it can lead to demotivation and a decrease in productivity, which is detrimental to employee morale and company culture.

Addressing pay compression and ensuring a fair and transparent compensation system are essential for maintaining trust and transparency in pay practices.

5 ways to fix pay compression issues

Get ahead of it — right now. If you do not recognize and acknowledge your pay compression problems, make that a priority. Every company has compression problems. It’s something we’ve all put on our “To Do” lists to manage over time. With pay transparency becoming a common topic of discussion, getting a handle on pay compression should be a priority.

There are many ways to approach identifying and handling pay compression, but here are some general steps to take:

- Get clear on your compensation and rewards philosophy. What are you paying for and what are the drivers of pay? How are individuals rewarded and how do you establish hiring pay rates? Make sure leaders are on board and that the philosophy is embedded in your administration of pay as it stands today.

- Note instances of pay compression. Spreadsheets are your friend in this situation. Resist the urge to address one-offs because there’s usually a ripple effect. Instead, document your pay drivers and expected pay differences in a consistent manner.

- Model resolution approaches. Identify where similar actions should be taken and formulas applied, and calculate the total financial impact.

- Prepare an implementation approach that considers timing, scope of financial impact, and communications planning. Be sure to obtain approval and buy-in from leadership.

- Communicate — and then communicate again. Develop a communications strategy that engages management by educating them on the organization’s compensation drivers and gives managers the confidence to explain changes to compensation.

Engage a partner

The size and scope of a company-wide pay compression project, particularly with the current state of the workforce and employee/employer contract, is complex and of critical importance. Perhaps, engaging in a partnership with a third party who has vast experience in handling pay compression would not only provide you with much-needed capacity but also lend some additional credibility and impartiality to such an important activity.

Mercer is ready to partner with you and create a custom approach that can meet the needs of your unique organization. Contact us at 855-286-5302 or surveys@mercer.com.