Supporting your hourly workforce for short- and long-term financial success

In today's complex financial landscape, individuals in hourly roles often find themselves grappling with what can seem like an insurmountable challenge: how to balance the urgency of immediate financial needs (e.g., bills, groceries, clothes) with the importance of addressing long-term financial goals (i.e., retirement, saving for college for children).

Employees in critical situations can find that their short-term needs overshadow any desire they have to plan for their long-term financial success. How can they be expected to put money away in a 401K when they are struggling to pay their monthly bills?

In this article, we offer insights and explore strategies that you can implement to help employees navigate this delicate balance and ensure they have a solid foundation for both short-term stability and long-term financial success.

Mercer’s Inside Employees’ Minds 2023 study found that hourly workers are primarily concerned with covering monthly expenses like rent and utilities, paying personal debts, including student loans, and saving money for retirement. Unfortunately, the current economic landscape, characterized by high inflation and market volatility, has exacerbated financial stress and concern among hourly workers whose already limited paychecks are being stretched thin by such difficult conditions. Because employers are not going to match pay raises to rising costs, the challenge to meet basic financial needs are compounded. We are all feeling the financial strain, but for your hourly employees, it’s financial pain.

When it comes to perceptions of compensation, 40% of hourly workers do not believe they are being paid fairly for their work, given their output and market conditions, which is 5% higher than the all-employee population. Why is this important? It is important you address these concerns because they directly impact your organization's ability to retain talent. In fact, you’re likely to see a 65% boost in employee commitment when employees believe they are paid fairly.

Employer strategies around addressing short-term financial security

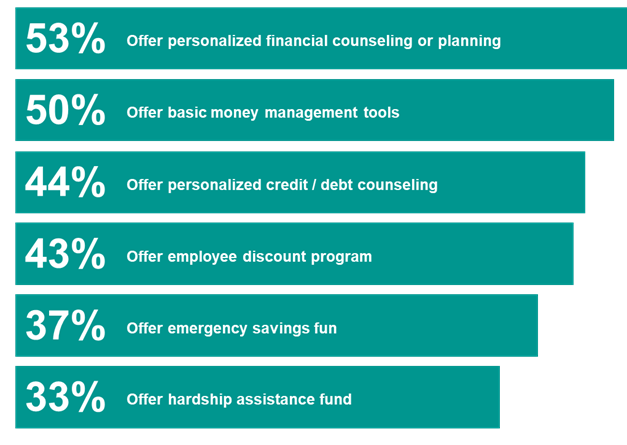

Some employers are already taking actions to mitigate their hourly workers’ financial concerns. You are familiar with programs like employee discount programs, emergency savings funds, and hardship assistance to alleviate some financial stressors associated with both daily spending and significant unexpected expenses. There are also money management tools and personal financial, debit, and credit counseling to equip your people with the knowledge and tools needed to navigate the current stressful economic landscape. Collectively, these financial wellness programs, which have increased in prevalence, aim to instill confidence in employees’ ability to cover their financial obligations and increase their financial stability.

Based on research from the Employee Benefit Research Institute’s Financial Wellbeing Employer Survey from September 2024, employers like you are implementing a myriad of financial wellness programs to support their workers for a more personalized experience.

The following are some specific programs tailored to hourly workers’ unique financial needs that companies have implemented, and you may want to consider.

Offer on-demand or earned wage access (EWA) pay to hourly employees, which provides them with immediate access to their earned wages, addressing the timing mismatch between income and expenses. According to data published in 2024 by the US Consumer Financial Protection Bureau, the popularity of these programs has grown in recent years, with the estimated number of transactions processed by employer-partnered earned wage products increasing over 90% from 2021 to 2022. This type of program can help you to alleviate financial stress for your hourly workers and improve employee satisfaction, while also potentially reducing the need for short-term credit and its associated costs.

Establish an emergency savings program to help your workers cope with unexpected financial emergencies by allocating funds specifically for unexpected emergencies. These programs can be designed in various ways, such as offering incentives for employees to save through employer-matching contributions. For example, if an employee contributes $100 from each paycheck, they receive a $5 matching contribution from their employer. Over time, these programs help your employees build a financial safety net to ensure that they are more likely to have funds readily available to handle unexpected expenses.

Provide access to financial coaching in the form of one-on-one guidance from a financial coach or Certified Financial Planner®. The guidance often includes a wide range of topics, such as financial budgeting, debt management, saving for a home or college tuition, and handling emergency expenses. Of course, for your hourly worker to realize the benefit of a financial planner without it being a financial burden itself, you should provide the service free of charge. In addition, you, the employer, can incentivize employee participation by offering rewards, such as a $50 contribution to an emergency savings account, to encourage the employee to improve their financial well-being.

Another option to support your hourly employees financially is to strengthen the benefits you offer. The 2023 data from Mercer’s National Survey of Employer-Sponsored Health Plans indicates that, in the coming fiscal year, over half of employers have vowed not to shift any health plan costs to employees and nearly 40% will offer a medical plan with little to no deductible. The objectives are to increase access to high-quality, affordable health care for the hourly worker, whereas typically they are not benefits eligible. Why would employers take such actions? Mercer's 2023 Inside Employees’ Minds study shows that implementing measures that enhance healthcare affordability for employees increases their commitment by 38%.

Communication and engagement strategies to support the hourly worker EVP

When your employees feel valued and understood, they are more likely to be committed to your organization and engaged in their work. A well-articulated EVP based in a tailored total rewards strategy can enhance employee engagement. Yet, Mercer’s 2024 US People Risks Study indicates only about one third of organizations have an effective employee value proposition in place, which includes tailored reward and benefits practices. Engage employees with your EVP by using a variety of targeted communication strategies to specifically meet the diverse needs of today’s hourly workforce:

Investing in a single, digital destination will connect employees to their employers through a curated site that allows employees to access their information and take action, such as benefit selection during open enrollment. Training and learning videos from your company’s financial benefits providers can be found in one digital destination.

Leading companies are proactively creating year-long editorial calendars and communication roadmaps infused with employee listening campaigns to plan the right message at the right time to the right stakeholder. This means that your call centers field fewer calls and your HR teams receive fewer emails. Employees can find what they need, when they need it, and focus on their work because of the thoughtful communications strategy, planned over a year-long glide path, that made each important message easier to digest. Would you like to start down this path? Many employers start with “persona” workforce segmentation to look at messages from the end user’s lens and will pilot communication strategies during the conventional benefits “Open Enrollment” period or other talent lifecycle key moments.

Equipping managers, HR business partners, and peer-level “influencer” or “change champion” networks with key messages and frequently asked questions, presentations, and physical tools — like brochures and posters — enable them to have one-on-one conversations with workers, further reinforcing important messages. Targeted coaching through cascaded, consistent messaging can provide valuable, personalized guidance to workers, helping them make informed decisions about their health and finances. You can then encourage managers and champions to infuse these talking points into daily “huddles” or in future staff meetings.

Exploring other strategies to meet the needs of the hourly workforce may include visual reminders like banners in the worksite or the company meal room; posting messages through worksite electronic display screens, company intranet microsites infused with short videos, and e-learning programs; and optimizing “Tier 0” support, like a chatbot, text help, or a call center to better serve employees who may not be comfortable with online self-service.

Opening the door for holistic financial well-being

Poor health can lead to financial strain and limit long-term financial well-being. You can prioritize your employee’s health and wellness in program offerings and communication, recognizing that good health is essential for building and preserving wealth. Medical expenses have a significant impact on discretionary income. You, as their employer, can support employees by offering solutions that reduce financial barriers to optimal healthcare, allowing funds to be allocated towards savings opportunities.

With a deep understanding of the complex financial landscape, Mercer recognizes the delicate balance between short-term financial security and long-term financial goals. Our comprehensive approach to addressing the unique challenges faced by hourly employees demonstrates our commitment to supporting your employee’s financial well-being and long-term success.

More information

I’m sure you can see that to address the financial concerns of your hourly employees there has to be a balance between short- and long-term considerations. Not sure what will work for your employees? Give Mercer a call – 855-286-5302 or email us at surveys@mercer.com.

Article written by:

David Kopsch, GRP, Senior Principal

Andre Rooks, Partner

Abby Labow, Senior Analyst

Brennan Rees, Principal

Ricca Racadio, Senior Principal

Sara Vipond, Senior Associate