Results of Mercer QuickPulse® on hot topics affecting your organization.

Mercer QuickPulse® surveys were developed to get your feedback and provide you with information on the topics popping up in today’s rapidly changing world of work. By quickly identifying these topics and getting our survey out to you, we can gather information on how you plan to address these issues, the concerns you have, and what you anticipate the impact will be to your organization and employees.

The June 2024 QuickPulse collected responses from over 600 organizations to questions regarding their approach to the new salary threshold for overtime exemption as well as how they are approaching and managing return to office.

Take a look at the findings below, Some answers might surprise you!

FLSA salary threshold requirement

In legislation passed in the US in April of 2024, the salary threshold for making someone exempt from overtime pay was increased. The first action was set to take place July 1, 2024 and the second, on January 1, 2025. With that second increase, the threshold will have increased more than 65% in less than 12 months — quite a significant change!

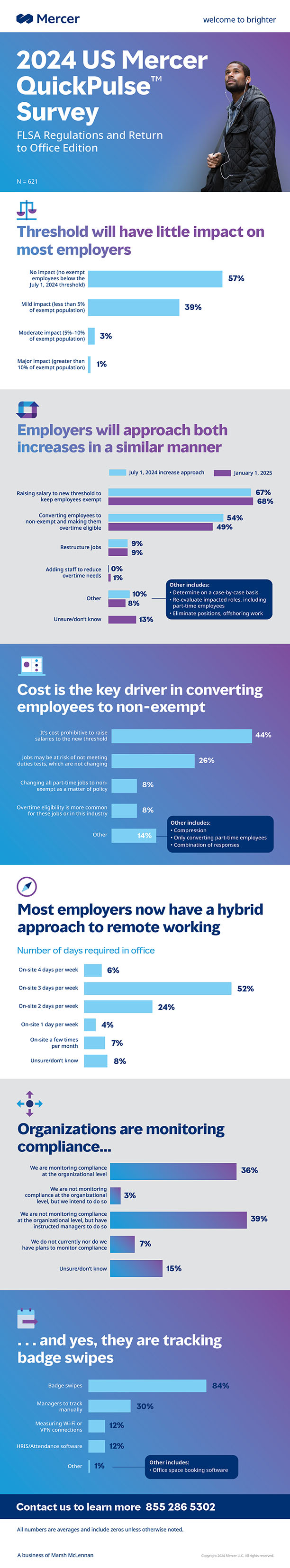

How are employers feeling about this new threshold? For many, the impact of this first threshold increase, to US$43,888, will not have much impact. More than half of the respondents in the QuickPulse stated that they don’t have any exempt employees below this new threshold. That’s great, but what about when the second threshold increase goes into effect January 1, raising it to $58,656? Well, they’re going to be facing a bigger challenge. Although less than 20% reported no impact, over half indicated there would be a “mild impact,” with 5% or less of their population impacted. However, only 15% of respondents are “very confident” that the January 1 salary threshold increase will stand. January 1, 2025 will be upon us before we know it, so we can be sure organizations are keeping a close eye on any developments with FLSA and the proposed threshold, and they are closely watching the presidential election to see if this topic is raised.

Approach determined on a case-by-case basis

A little over two thirds of organizations will increase employees’ salary (to at or above the threshold) to keep them exempt from overtime. However, about half will also be converting salaried exempt employees to hourly and making them eligible for overtime, which requires significant change management. Other tactics involve restructuring jobs and adding staff to reduce overtime needs.

Most organizations will decide to utilize multiple approaches, as it’s very unlikely that any single remedy can be applied across the board. You’ll likely find some jobs that should be reclassified as hourly when you look at the new salary threshold in conjunction with the duties test as well as some that are solidly exempt and should be raised to the new salary threshold. You’ll have to take a look at each job in question and make a decision. Salary surveys can be helpful when you are making these decisions. Read “Yes, salary surveys can help with your FLSA decisions!” for helpful tips.

So, how are organizations setting the new hourly rate for employees who will be reclassified? The most common approach will simply be to convert the salary to hourly pay using the full-time equivalent as the divisor, meaning the hours a full-time employee works in a week (e.g., 40 hours). While making these employees eligible for overtime could add cost, they are costs that can likely be controlled by managing hours. That said, it’s important to make sure the workload is not simply shifted to employees who are remaining exempt. After all, we’re continuing to hear the impact that burnout has on our employees. According to Mercer’s 2023 Inside Employees’ Minds Study, workload/life balance is the number three employee concern, right behind covering monthly expenses and being able to retire.

When the decision is made to increase an employee’s base pay to meet the new threshold, the employee will experience a compounded increase in cost with future annual increases as well as short- and long-term incentive payouts.

What else are companies considering due to this change in the FLSA salary threshold? Job description reviews, pay compression analysis, market competitiveness assessments, and job architecture creation/updates top the list of areas to revisit.

The current return to the office conversation

It’s been about a year since we saw several big name companies calling employees back to the office. While employee engagement surveys show that many employees are happy being back in the office for some amount of time, the media coverage of employees who will not accept the change has not slowed.

Just how is return to office going? Let’s take a look at what organizations are saying.

Almost 70% of organizations have implemented an office-centric hybrid work model, with most requiring two or three days per week in the office. To entice employees to comply, and perhaps make their time in the office a bit more enjoyable, employers are offering relaxed dress codes, flexible working hours, subsidized parking, and a few other incentives. However, you would be one of the few if you decided to implement things like free meals, childcare assistance, stipends, or adjustments in pay for being in the office.

The most common approach to determining days in office is to let managers do so for their team (29%). The second most common approach is that the company sets required office days for all employees. About 30% of companies are taking a hard-line approach. They’ve issued a return to office mandate and employees are expected to comply. Others are taking a more flexible approach and considering individual needs. Of the employers who report monitoring compliance, badge swipes are the most common approach (84%).

How do these results compare to what’s happening at your company? If you need help creating an approach to compliance with the new overtime threshold or making return to office work for your organization, pick up the phone and call us at 855-286-5302 or send us an email.