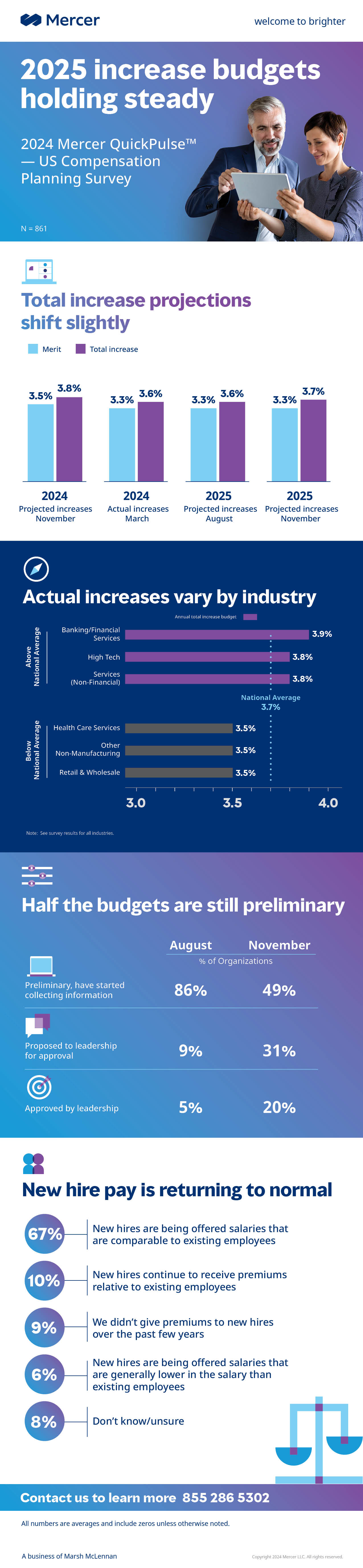

It looks as though employers are standing firm in terms of their projected annual increase budgets for 2025. Average merit projections matched the 3.3% they reported in August and average total increase projections only shifted to 3.7%, from 3.6%.

However, only 20% of the 861 respondents have finalized their budgets; 49% are still in the preliminary phases of collecting information. Is there a chance we will see budgets change significantly between now and when they are delivered in Q1 of 2025? Possibly.

Variations in base pay increase budgets

We always see some differences in budgets from one industry to another. Year after year, at least for the past several years, healthcare, unfortunately, sets aside a smaller percentage for annual increases than other industries. This coming year looks no different. Healthcare Services reported the lowest average merit increase budget at 3.0%, though they do seem to make up for it a bit with an average of 3.5% budget for total increases, which is closer to the national average. Insurance & Reinsurance as well as Retail & Wholesale are projected below the national average as well, with merit budgets of 3.2%.

We do see that a few industries are above the national average merit increase budget:

- 3.4% — Banking/Financial Services; Life Sciences; Other Manufacturing

- 3.5% — Energy; High-Tech

While most segments of the labor market have become more stable, the one that still leaves employers struggling is the hourly workforce. Enticing hourly workers to take and keep jobs remains a challenge. However, the national average for the Non-Exec Hourly merit budget is 3.2%, which is less than the overall national average. Looking at industries that are heavily reliant on hourly workers, we see more of the same, below the national average:

- Healthcare Services — 2.9% merit budget for hourly workers

- Other Manufacturing — 3.2% merit budget for hourly workers

- Retail & Wholesale — 3.1% merit budget for hourly workers

The respondents that classify their budget as final or “approved by leadership” have an average of 3.3% set aside for merit and 3.6% for total increases. As you are finalizing your budgets, perhaps take that number as an indicator of the national average and take directional guidance from the industry numbers.

Just under two thirds of companies reported that they have or will provide off-cycle increases in 2024.

Timing of survey

Companies completed the survey prior to the US presidential election. Mercer wondered whether that timing may have an impact on the uncertainty of budgets. We asked “how (the) outcome of the US election is likely to affect organizations’ increase budget.” Most organizations responded that it was extremely or somewhat unlikely that the election results would affect the budget. Only 6% of organizations said that there would likely be an impact.

Promotions

Similar to prior years, on average, companies do plan on promoting between 9% and 10% of their workforce in 2025, delivering a 9.3% pay increase on average for a one-level promotion. The highest percentage of any one group of employees expected to be promoted is the Non-Executive (Salaried) group, which you can think of as the professional and management group. Conversely, employers only plan to promote 6% of Executives, which is understandable.

Following the trend of the last couple of years, organizations that have a separate promotional budget are averaging 1% of the overall salary budget.

New hire pay

We know that most of the accelerated or elevated pay practices that took place in the tight labor market post COVID have all but disappeared. What about paying premiums for new hires? Sixty-seven percent of the organizations surveyed said that they offer salaries to new hires which are comparable to those of current employees. Another 9% said “We didn’t give premiums to new hires over the past few years.”

Moving forward

The next Mercer QuickPulse® US Compensation Planning Survey will open for participation in mid-March of 2025. That’s the survey where we will find out what exactly happened during the annual increase season and publish those results in our report in April. Will a new US president’s first days in office have any impact on how companies spend their budgets in 2025? Or, will some other economic factors impact the final budgets and actual spending for total increases in the new year? We’ll have to wait and see!

In the meantime, reach out to us for help on any of your year-end compensation planning or even to get a jump start on 2025. Call 855-286-5302 or email surveys@mercer.com.